Fuel tax credits allow businesses to claim a credit for the fuel tax (excise or customs duty) included in the price of fuel.

To claim a fuel credit, the business must be using an eligible fuel in an eligible business activity.

Eligible Fuels

Fuel tax credits can only be claimed on taxable fuel. Taxable fuel is where fuel tax – excise or customs duty - has been paid.

Eligible fuel examples:

- Petrol

- Diesel

- Liquefied Petroleum gas (LPG)

- Liquefied Natural gas (LNG)

Ineligible fuel examples:

- LPG and LNG delivered for residential heating

- Bulk non-transport LPG – Invoice generally includes ‘not to be used, or supplied for transport use. Penalties apply'

Blended fuels

There are specific rules for blended fuels and whether a fuel meets the required definition for fuel tax credit purposes. Further information is available on the ATO website.

Eligible Activities

To claim fuel credits, fuel must be used in an eligible activity.

There are three general categories of activities:

1. Road Transport

Fuel Tax Credits can be claimed for heavy vehicles that travel on public roads and meet both of the following conditions:

- The heavy vehicle is used in carrying on a business and

- The vehicle has a gross vehicle mass (GVM) greater than 4.5 tonnes

2. Other Businesses (includes Agriculture, Construction, Landscaping, Manufacturing, Mining & Property Management)

Fuel Tax Credits can be claimed where vehicles are used in the following manners:

- Private roads

- Off public roads

- Non-fuel uses

Note: Light vehicles – can only claim fuel used on private roads and off public roads.

FTC are not able to be claimed on fuel for light vehicles used on public roads

3. Packaging / Supplying fuel

Fuel tax credits can be claimed on certain liquid and gaseous fuels depending on their size and purpose.

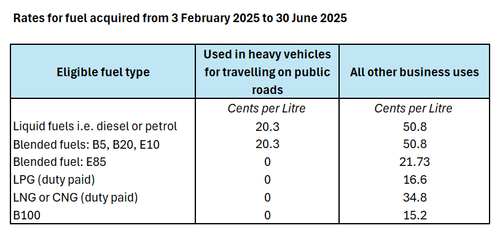

Fuel Tax Credit Rates

Fuel tax credit rates are indexed twice a year – February and August - in line with the Consumer Price Index (CPI).

The rates also change when the road user charge on fuel changes for heavy vehicles on public roads.

Prior period rates

Registration for Fuel Tax Credits

Fuel Tax Credit registration can be added at any time however you must be registered for GST at the time you acquired the fuel and it must be within the previous four years.

The Fuel Tax Credit's are claimed on your Business Activity Statement i.e. monthly, quarterly or annually.

ATO Tools

The ATO provides a number of tools to assist businesses in working out whether they are conducting an eligible activity and whether the fuel is eligible.

ATO Fuel Tax Credit eligibility tool

https://www.ato.gov.au/single-page-applications/calculatorsandtools?anchor=FTCEL#FTCEL/questions

ATO Fuel Tax Credit Calculator

https://www.ato.gov.au/single-page-applications/calculatorsandtools#FTCCalc/questions

If you would like assistance in determining your Fuel Tax Credit eligibility, please contact Cambrian Hill Accounting.